Would it surprise you to learn that Fair Labor Standards Act (FLSA) lawsuits are at an all-time high? Much of this trend is due to unique and ongoing changes in the workplace, as well as new initiatives by the Department of Labor (DOL). As employers continue to adapt to hiring and staffing challenges, they need to be certain they’re paying remote workers for all hours worked, not misclassifying independent contractors who should be treated as employees, and upholding the latest minimum wage and overtime pay requirements for non-exempt employees. The DOL is stepping up enforcement of the rules, announcing in February 2022 that it will hire 100 new wage and hour investigators, in addition to dedicated agency lawyers.

Because FLSA litigation and enforcement are expected to surge in the coming years, every employer must be aware and proactive. What are the risks, and how can you reinforce your practices to protect your business?

The Cascading Effect of Non-Compliance

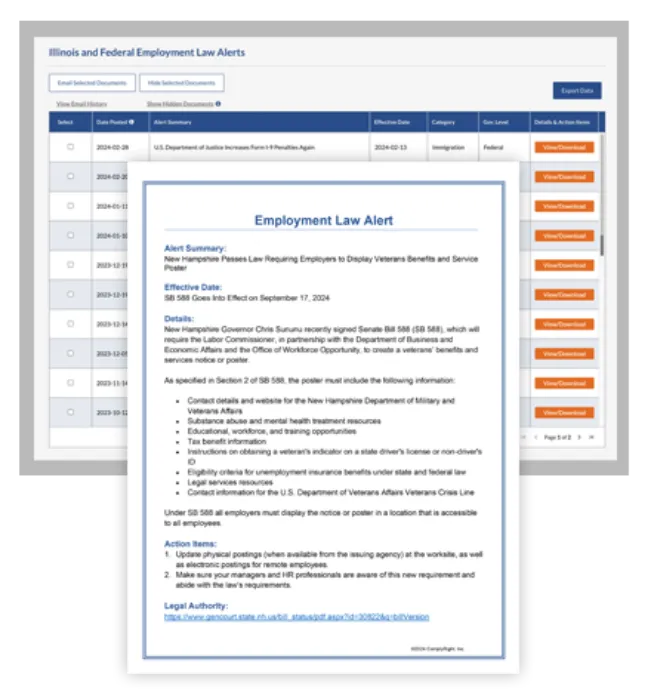

All it takes is a disgruntled employee or former employee filing a complaint with the DOL to trigger a full investigation of your pay practices, including compliance with the federal minimum wage, overtime, child labor, and proper timekeeping and recordkeeping. This includes posting certain federal and state postings, such as the DOL notice informing employees of their rights under the FLSA.

Beyond the risk of fines – as high as $38,000 per location for federal violations, with state and local posting fines ranging from $100 to $1,000 per violation — failure to post can set off additional legal issues:

- Extends ‘statute of limitations’

This forces you to defend old claims that should have been dismissed or time-barred (two years under the FLSA). The result is two-fold: a longer recovery period for back wages and higher damage awards, especially in FLSA class-action lawsuits.

- Evidence of ‘good faith’ or ‘bad faith’

Under various employment laws, courts can impose additional damages for “bad faith” (and, in turn, reduce or excuse violations where “good faith” exists”). FLSA plaintiffs can even double damages if there are signs of bad faith, which can include failing to display the appropriate postings.

The Fair Labor Standards Act (FLSA) is the primary federal law that establishes standards regarding minimum wage, overtime pay, child labor, and timekeeping and recordkeeping.

Take a Comprehensive Approach to Compliance

In today’s climate of increased FLSA enforcement, you need to be particularly diligent with your practices. To ensure complete compliance, follow these pointers:

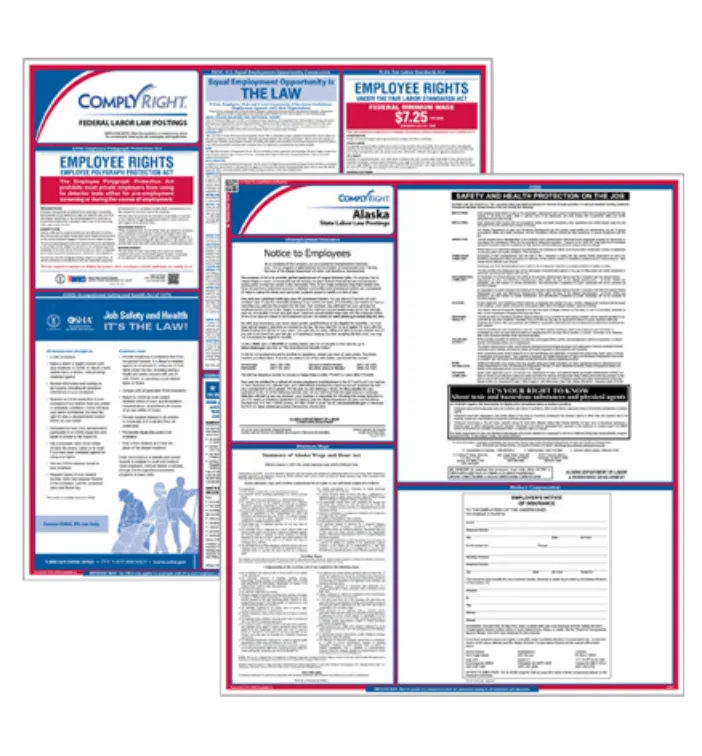

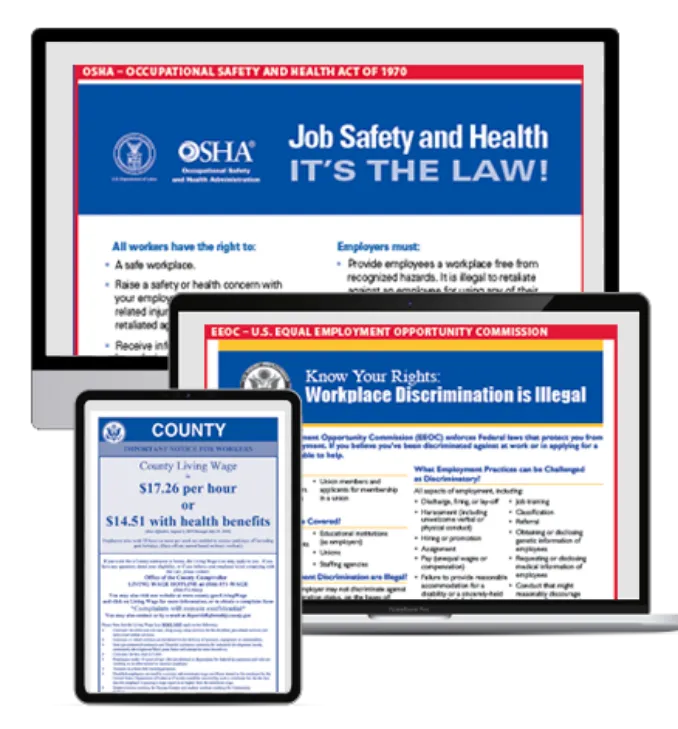

- Display physical postings in the workplace – or share electronic postings with off-site workers – regarding applicable federal, state and/or local minimum wages (even if the wages conflict).

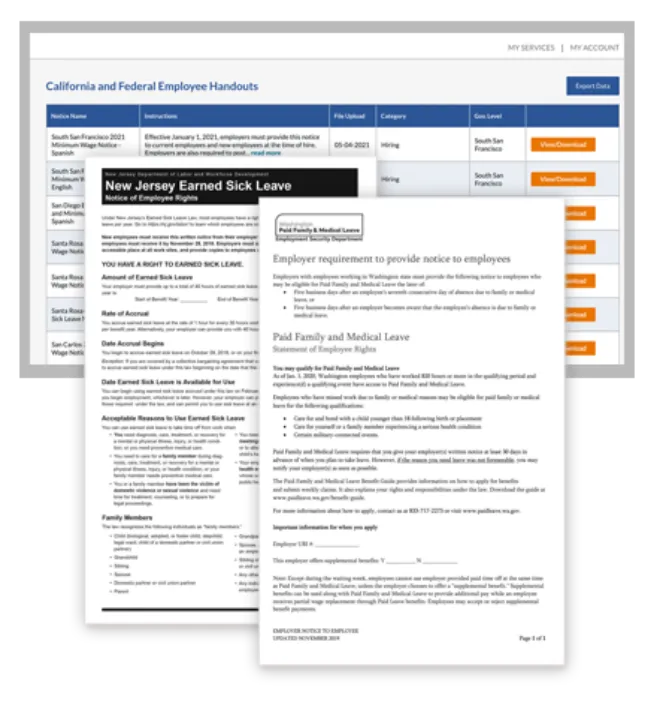

- Distribute state-specific employee handouts covering wage theft, which is when employers don’t pay their staff what they’re rightfully owed, whether through minimum wage and overtime violations or by expecting employees to work ‘off the clock’ or taking illegal deductions.

- Rely on our dedicated service, Poster Guard® Compliance Protection, for 365 days of guaranteed, attorney-backed labor law posting compliance. You’ll receive an up-to-date federal, state and local poster set, along with automatic poster replacements every time a mandatory change occurs.